Help your employees access £1,219 in lost tax relief

Your team could be paying thousands in overpaid tax because of your workplace pension. We help fix that.

£137,783 refunded so far

Your NEST Pension is costing your team thousands - and it's time they knew about it.

Pension contributions should be tax-free. For many, it isn't. Finance teams know this but it's difficult to tell your team without giving tax advice. Until now.

We make it risk-free to tell your team

Finance teams are nervous to tell their teams about the tax relief issue caused by your workplace pension. You know it will open a can of worms - and you can't give your team tax advice. We solve this. By using Free Pension you can do the right thing and inform your team about the tax relief they are owed. We take care of all the admin, questions and hassle - so you don't have to.

Your team receive £1,219 each

Free Pension answers their questions

Happy employees who are a little richer

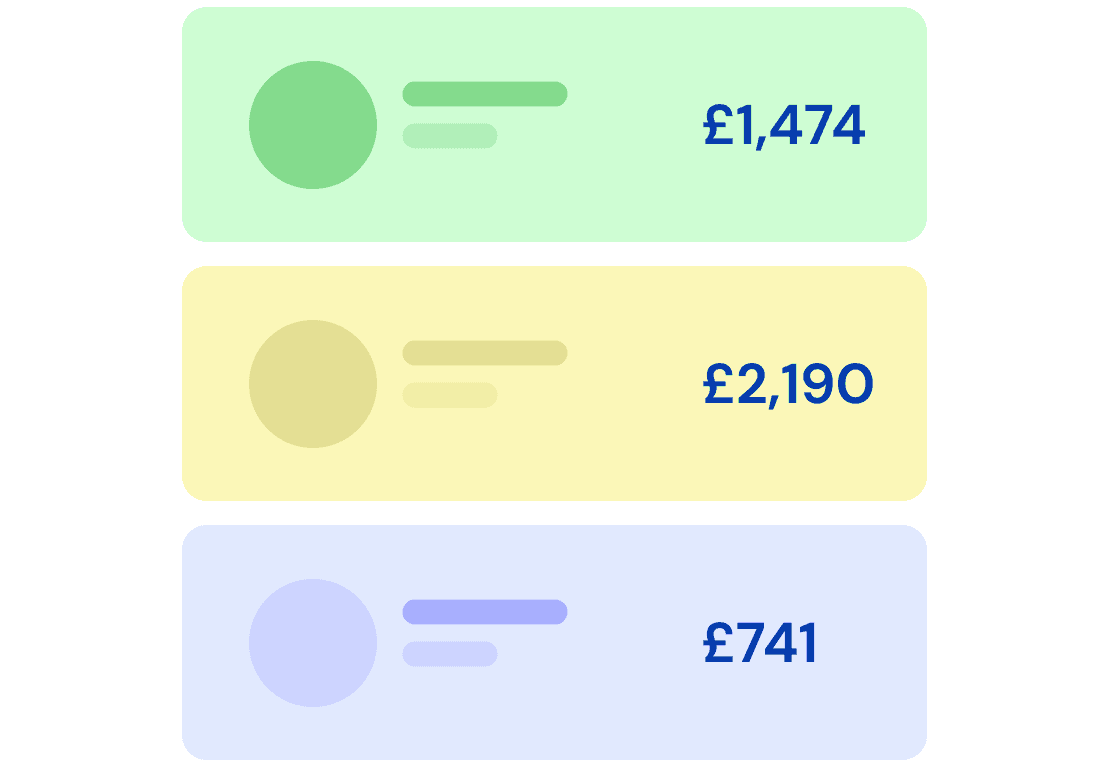

How much does this problem cost your team?

The average Free Pension user received £1,219. This is refunded straight to their bank account, tax-free. So a team of 100 employees could be missing out on over £100,000. This is all money that belongs to you and your team - you just need some help claiming it.

We help your team access their tax refunds and answer all their queries along the way

Invite your team and we take it from there. All you have to do is sit back and track the thousands of pounds you have helped your team get their hands on. Oh, and maybe you'll be owed a little yourself.

1

Invite your team

Once you sign up, you'll get a unique company URL. Simply share it with your team and leave the rest to us.

2

We manage their refund

Your team calculate their refund and we'll check everything before submitting the refund to HMRC.

3

Track the refunds

Refunds are paid directly to your employees bank account. Track the total amount via your dashboard.

Get setup in 5 minutes flat

Once you have signed up, upload your employee emails via a CSV and we'll manage it from there directly with your employees. We'll introduce them to Free Pension via email with an invitation to our eligibility quiz.

Add a bank card

Invite your team

Leave the rest to us

We support your team through their refund

We take care of explaining to your team how pension tax relief works so you can avoid the questions and the risk of giving tax advice. Once your company sign up, we'll invite each employee to Free Pension via email. Your team will get started with our eligibility quiz. We'll then ask for some more information and calculate their estimated refund.

"It’s been super easy. And no one is asking me questions about pension tax relief anymore"

Sarah Cadwallader, Finance Director at Otta

Track the thousands your team have been refunded

Once the refund is calculated, we take care of all the admin for your team and submit it to HMRC. Within 4-6 weeks the refund will be paid directly to your employee's bank account. Company Admins can access a dashboard to track the number of refunds and total amount refunded.

"Very simple and straight-forward guidance to claim pension related tax relief! Support is blazing fast to respond to any query you may have; great stuff!"

Yorgos, an employee using Free Pension

Next stop. One million pounds refunded.

refunds so far

refunded

average refund

Don’t take our word for it

Let's talk money

We're on a mission to help as many people as possible. To achieve that, we keep our prices low and fair.

Free Pension costs £39 per eligible employee. There's no tricks or hidden costs. You only pay for employees who sign up and pass our eligibility quiz.

The average company pays £600 and their team receive £24,380 in refunds. A 40x return for your team.

Estimate your personal refund

Calculate how much you could be refunded in 30 seconds.

What's the ROI of Free Pension?

Calculate the cost of Free Pension to your company and the return-on-investment for your company.

Estimate total employee refunds

Based on the number of employees you have, we'll calculate how much your whole team could be owed.